The 5 best expense management software options in 2024

Managing expenses can be a real headache, especially when you’re juggling receipts, invoices, and spreadsheets. Read on to find out the best expense management software you need to eradicate that headache for 2024 and beyond!

Are you sick of the expense management headache that comes with juggling receipts, invoices, and spreadsheets?

Then fear not, because 2024 has brought some amazing expense management software to make your life a whole lot easier. Whether you’re a small business owner, a finance manager, or just someone who likes to keep their spending in check, these tools will have you covered.

Here are the five best expense management software options for 2024, including a star player you might have heard of: Budgetly!

Key features of the best expense management softwares

The best expense management tools come with a variety of features designed to simplify the financial processes within your organisation. These features typically include:

Automated expense tracking:

Automatically capture and categorise expenses in real-time.

Corporate card integration:

Issue physical and virtual cards with pre-set spending limits.

Receipt capture and management:

Snap photos of receipts using a mobile app for easy documentation.

Approval workflows:

Configure multi-level approval processes to ensure compliance with company policies.

Accounting software integration:

Seamlessly sync with popular accounting systems like Xero, QuickBooks, and MYOB.

Multi-currency support:

Handle international transactions and currency conversions effortlessly.

Data security:

Employ robust encryption and security protocols to protect sensitive financial information.

The 5 Best Expense Management Software Options in 2024 for Australian Businesses

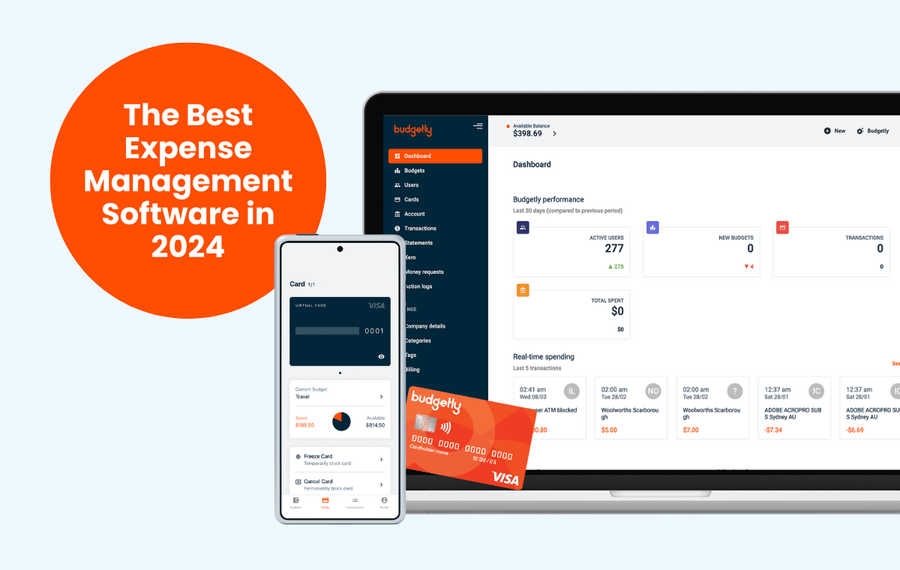

1. Budgetly

First up, let’s dive into Budgetly, recently recognised as a Culture 100 Growth Award Winner for 2024, Budgetly has been making waves in the expense management world the software that’s making waves in the expense management world.

Designed with both simplicity and power in mind, Budgetly is perfect for businesses of all sizes.

Why Budgetly is a game-changer:

- Real-time tracking: Say goodbye to the days of manually inputting expenses. Budgetly allows you to track spending in real-time, giving you instant insights into where your money is going.

- Customisable categories: Tailor your expense categories to fit your business needs. Whether it’s travel, meals, or office supplies, Budgetly lets you create and manage categories with ease.

- User-friendly interface: The intuitive design ensures that everyone on your team can use Budgetly without a steep learning curve.

- Integration with accounting software: Seamlessly sync Budgetly with your existing accounting tools like QuickBooks, Xero, and MYOB, making expense reporting a breeze.

- Mobile access: With the Budgetly mobile app, you can manage expenses on the go. Snap photos of receipts, approve expenses, and monitor budgets from anywhere.

Why choose Budgetly?

Budgetly is perfect for small businesses and startups looking for an affordable, easy-to-use expense management solution. Its emphasis on real-time tracking and customisable reports makes it a standout choice in 2024.

|

Pros:

|

Cons:

|

2. MYOB

Next on our list is a name that many of you might already be familiar with— MYOB. This homegrown Aussie favourite has been a staple in the accounting and expense management world for years, and it’s still going strong in 2024.

What makes MYOB special?

- Comprehensive features: MYOB offers a wide range of features that cover everything from expense tracking to payroll and invoicing. It’s an all-in-one solution for managing your finances.

- Cloud-based: MYOB’s cloud-based system ensures that you can access your financial data from anywhere, at any time. Plus, your data is securely stored and backed up.

- Integration with Australian banks: MYOB integrates seamlessly with major Australian banks, making it super easy to import and categorise your transactions.

- Compliance with ATO regulations: Keeping up with tax regulations can be a headache, but MYOB has got your back. It ensures compliance with the Australian Taxation Office (ATO), so you can rest easy come tax time.

Why choose MYOB?

If you’re running a small to medium-sized business in Australia, MYOB is a solid choice. Its comprehensive features and seamless bank integrations make it a powerful tool for keeping your finances in check.

|

Pros:

|

Cons:

|

3. SAP Concur Australia

Lastly, we have SAP Concur Australia. If you’re part of a larger organisation or a corporate giant, SAP Concur could be the heavyweight champion you’ve been looking for.

What makes SAP Concur a powerhouse?

- Automated expense reporting: SAP Concur’s automated expense reporting saves you time and reduces errors. It automatically captures and categorises your expenses, making the reporting process a breeze.

- Advanced analytics: Dive deep into your financial data with SAP Concur’s advanced analytics. Identify spending trends, pinpoint cost-saving opportunities, and gain valuable insights into your company’s finances.

- Global reach: With SAP Concur, managing expenses across multiple countries is no longer a challenge. Its global reach ensures that you can track and manage expenses no matter where your business takes you.

- Integration capabilities: SAP Concur integrates with a wide range of other business systems, from ERP and CRM systems to travel booking tools. This seamless integration makes it easier to manage all aspects of your business.

Why choose SAP Concur Australia?

For larger enterprises with complex expense management needs, SAP Concur may be the ideal choice. Its advanced features, global capabilities, and integration options make it the go-to solution for big businesses.

|

Pros:

|

Cons:

|

4. Zoho Expense

Zoho Expense has quickly become a trusted name in expense management, offering a streamlined solution for companies looking to manage their finances with ease and accuracy.

Why Zoho Expense is a game-changer:

- Automated expense recording: Say goodbye to tedious data entry. Zoho Expense can automatically record expenses from receipts, saving time and reducing errors.

- Approval workflows: Set up multi-level approvals to ensure that all expenses go through the proper channels, making your approval process both efficient and transparent.

- Comprehensive reporting: Zoho’s powerful analytics tool lets you generate detailed reports to track spending, identify patterns, and optimise budgets.

- Global support: Perfect for international teams, Zoho Expense supports multiple currencies and tax configurations, making it ideal for global businesses.

- Mobile capabilities: With the Zoho Expense app, users can track, submit, and approve expenses from anywhere, making it perfect for on-the-go business needs.

Why choose Zoho Expense?

Zoho Expense is ideal for growing businesses and enterprises looking for a scalable solution with advanced automation and detailed reporting. Its global support and flexible approval workflows make it a go-to for companies with diverse, international teams.

|

Pros:

|

Cons:

|

5. Weel Expense Management

Lastly, Weel Expense Management has gained a reputation for delivering a modern approach to expense tracking and management, simplifying financial processes for busy teams.

Why Weel is a game-changer:

- Digital wallets for employees: Weel provides digital wallets, allowing employees to manage their expenses directly through a Weel card, giving businesses control over spending limits.

- Instant expense reports: By automatically categorising transactions, Weel enables instant, accurate expense reports, freeing employees from manual submission.

- Real-time expense control: Managers can set specific spending policies, instantly track usage, and receive notifications for transactions in real-time.

- Customisable workflows: Tailor the approval and reimbursement process to meet your company’s unique policies and requirements.

- Seamless integrations: Weel integrates with popular accounting platforms like Xero and MYOB, allowing for smooth data flow and simplified reconciliation.

Why choose Weel?

Weel is perfect for companies seeking a flexible, intuitive solution that offers precise control over employee spending. Its unique digital wallet feature and seamless integration make it an innovative choice in expense management for 2024.

|

Pros:

|

Cons:

|

How to choose the right expense management software for your business

Selecting the right expense management tool for your business involves considering several factors:

Business size and needs:

Assess the scale of your operations and the specific features you require.

Budget:

Determine your budget and compare the pricing plans of different tools.

Ease of use:

Opt for a tool with a user-friendly interface to ensure smooth adoption by your team.

Integration capabilities:

Ensure the tool integrates seamlessly with your existing accounting and financial systems.

Scalability:

Choose a solution that can scale with your business as it grows.

Customer support:

Look for providers that offer robust customer support to assist with any issues.

By carefully evaluating these factors, you can choose an expense management tool that not only meets your current needs but also adapts to your future growth.

Final thoughts to consider...

And there you have it—five of the best expense management software options in 2024! Whether you’re a startup just getting off the ground, a growing small business, or a massive enterprise, there’s a solution out there for you.

- Budgetly stands out as the clear winner for those seeking an intuitive, affordable solution with unmatched real-time tracking capabilities.

- MYOB offers solid features and seamless bank integrations, particularly suited for Australian businesses.

- SAP Concur Australia caters to enterprises with advanced expense management needs.

- Zoho Expense provides automation, multi-currency support, and integration with popular accounting tools.

- Weel Expense Management is a flexible option for teams looking for a card-based solution that simplifies approvals and spending tracking.

See how Budgetly can work for your business, schedule a demo with us today, or watch a 10-minute recorded demo.