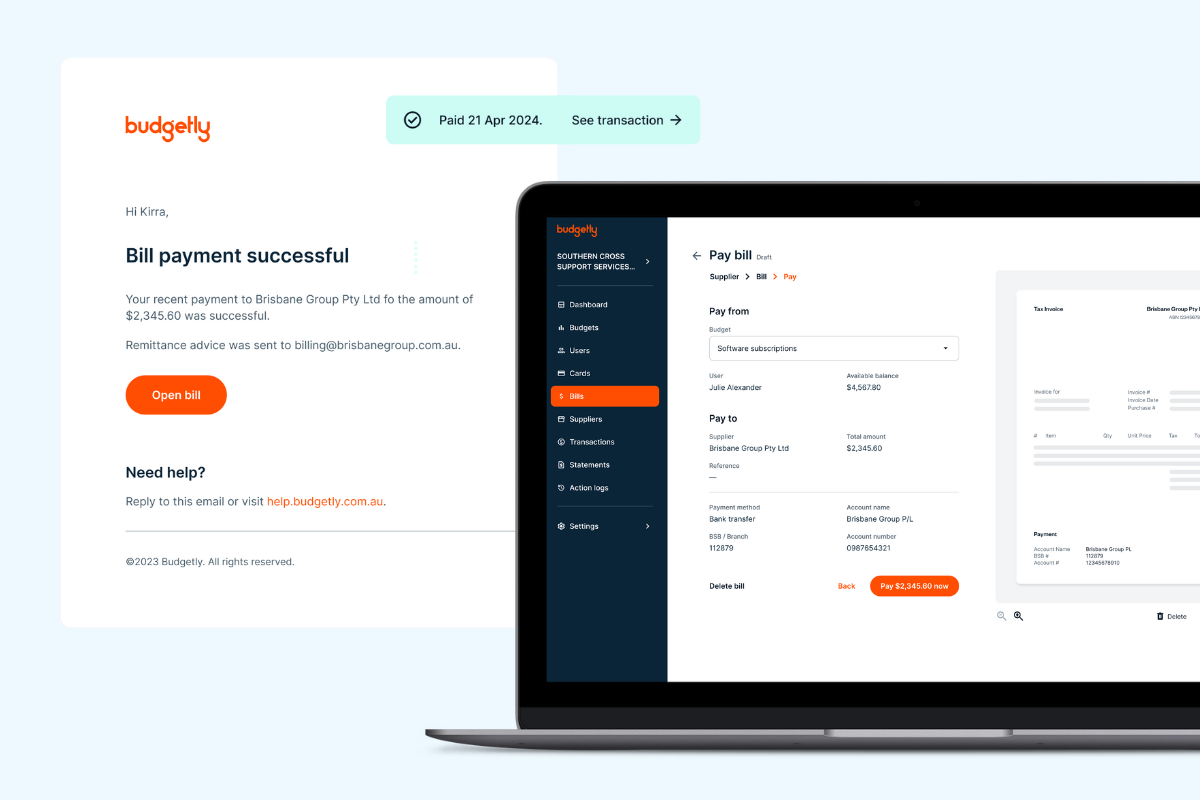

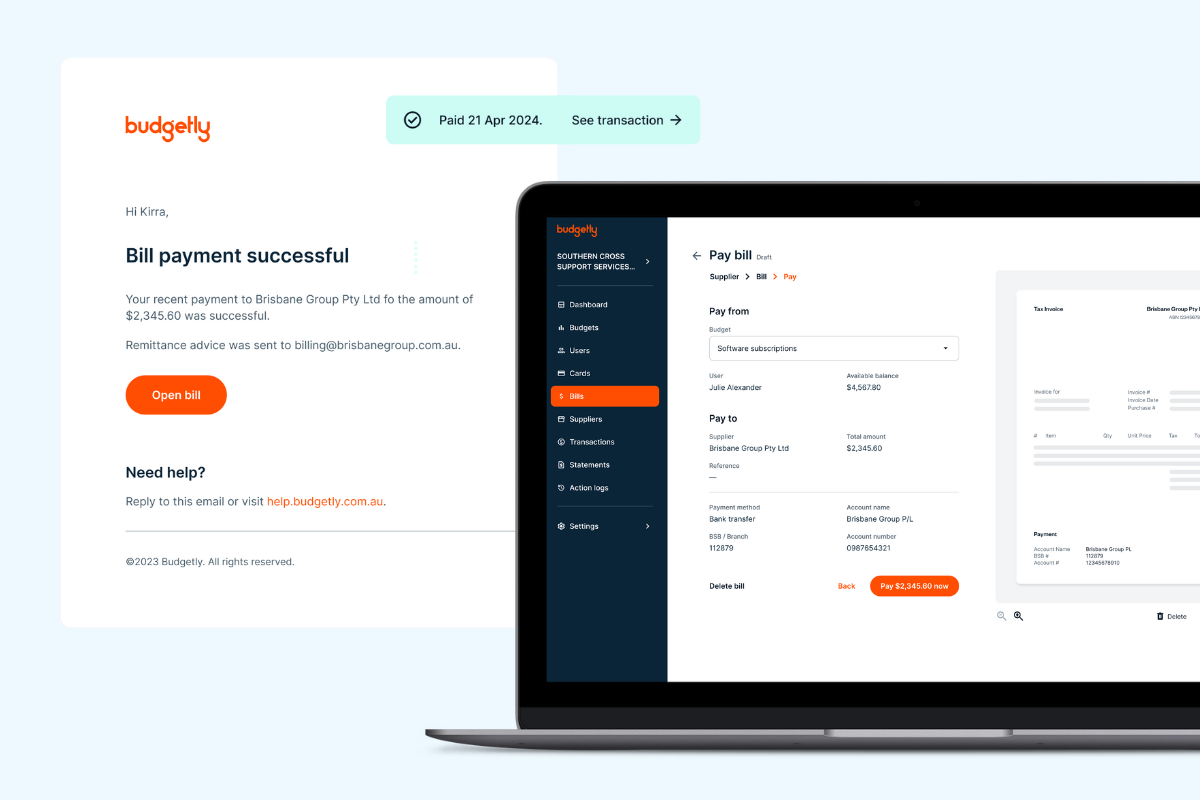

Budgetly, the leading Australian spend management software provider, today announced the innovative launch of Budgetly Bill Payments, an integrated bills payment solution, set to transform the payment landscape for businesses and employees.

Budgetly, the leading Australian spend management software provider, today announced the innovative launch of Budgetly Bill Payments, an integrated bills payment solution, set to transform the payment landscape for businesses and employees.