Budgetly debit cards are better than just a fuel card

Enjoy real-time tracking, spending limits, and comprehensive reporting. Control and manage more than just your company's fuel expenses with Budgetly.

Empower your employees with real-time issuance of corporate prepaid cards and say goodbye to petty cash, endless paperwork and waiting on the big banks.

We're proud to be recognised with multiple industry awards, thanks to our many happy Budgetly customers.

Empower better spending with the best fuel card alternative

Easily set spending rules with approved funds for an empowered team. Budgetly’s virtual corporate cards removes tedious manual admin work of chasing receipts for reimbursement, which means a happier, less stressed finance team!

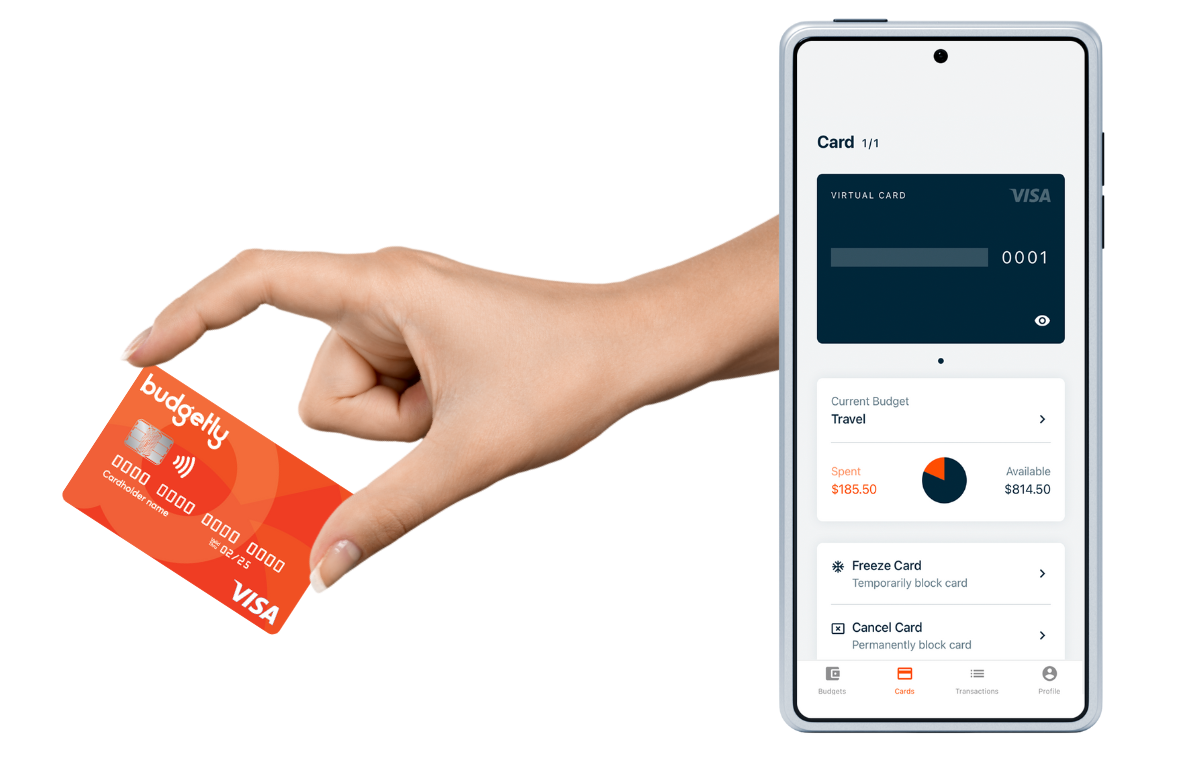

Eliminate card sharing hassles

The convenience of physical and digital corporate prepaid cards eliminates the need for expense reimbursements.

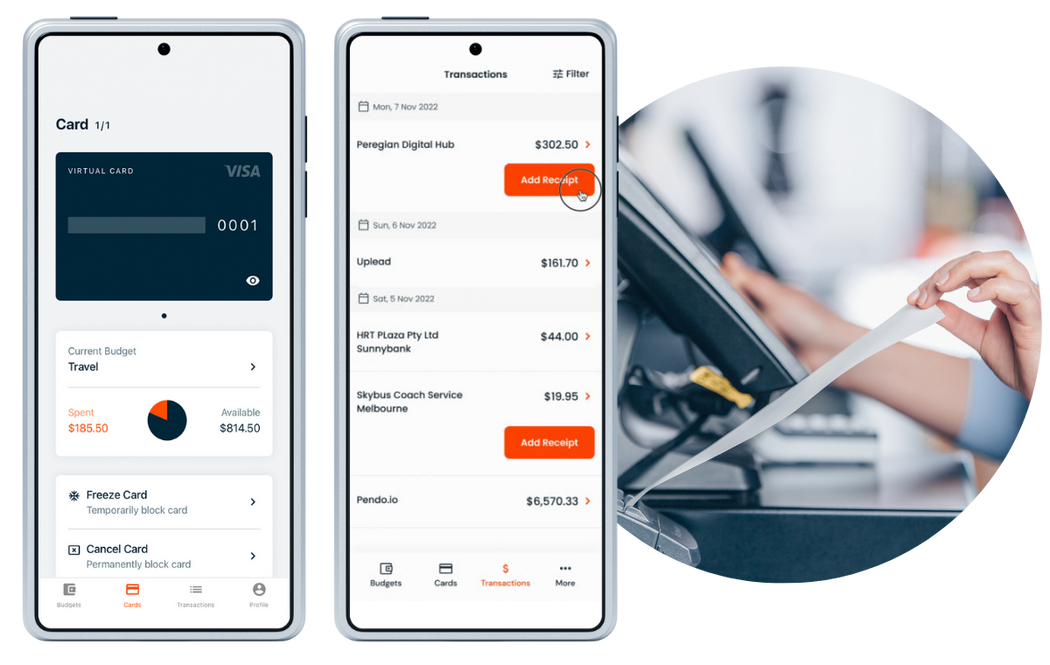

Real-time expense tracking

Monitor your expenses in real-time, ensuring you have up-to-date insights into your financial activities and can make informed decisions instantly.

Cancel or freeze cards easily

Easily cancel or freeze your cards with just one click, ensuring instant control over your account security.

Complete transaction visibility

Effortlessly manage your business expenses with real-time tracking and detailed transaction records, available at your fingertips.

Empower your teams with a better fuel card!

“Without Budgetly, time and money would have continued to leak. We previously had very little control over what staff purchased and how much they had spent.”

David Killpack, Owner

Project E2 (Sunshine Sailing Australia and Learn to Sail)

“With Budgetly, the expense management process now with virtual corporate prepaid cards means that there is a record of all transactions which is far better than a cash system.”

Greg Massam, CEO

Directions Disability Support Services

“Budgetly has saved at least 4-5 hours a month in general admin work.”

Bert Bos, Accounts

Australian Christian Churches (ACC)

“Neither bank debit cards nor fuel cards suited our business at this size. Budgetly's corporate prepaid cards do. Very close to 100% of issues with staff expenses have been resolved by implementing Budgetly.”

Ben Dixon, Director

Hunt & Dixon Surveys

“Budgetly's corporate prepaid cards have solved all of our issues. Everything in one spot. End of month reconciliation is much easier than it was before!”

Brodie Chapman, Finance Administrator

Inclusive Disability Assist

Instant card issuance

Get your new virtual corporate prepaid cards issued immediately with Budgetly, so you can start using it without any delay.

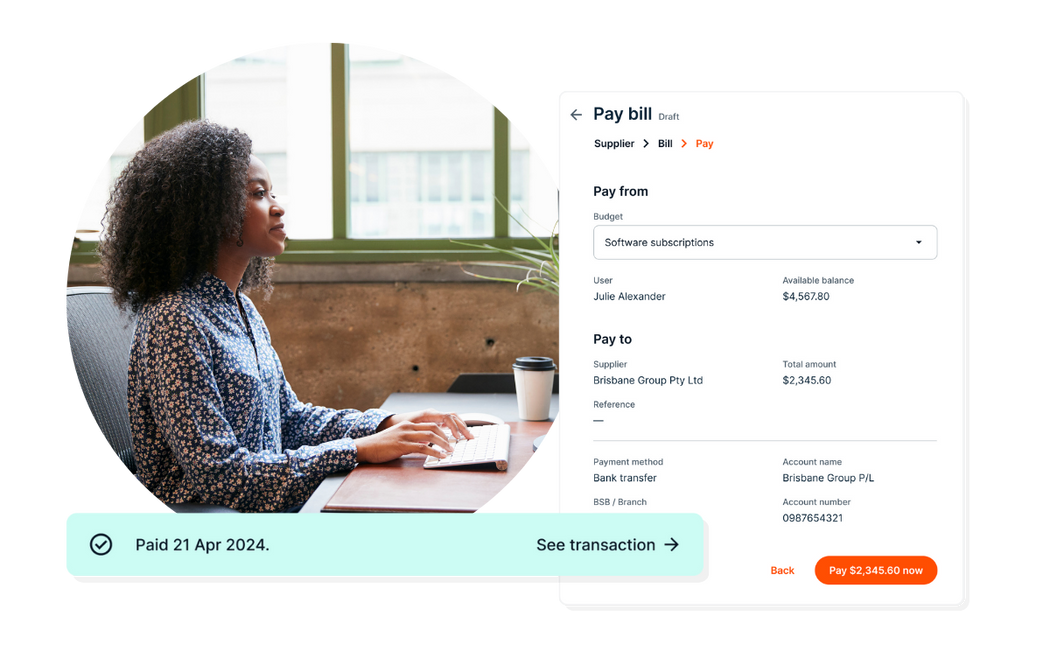

Flexible spending

Enjoy the freedom of flexible spending with Budgetly, allowing you to adjust your corporate prepaid card limits and manage expenses according to business needs.

Empower employees

Budgetly revolutionises the way Australian businesses handle company expenses and bill payments. Designed with employees in mind, our product ensures easy access to funds and compliant spending.

The best fuel card alternative for your employees

Discover why Budgetly has the best virtual corporate cards for your business.

With Budgetly’s instant virtual corporate cards staff can transact, capture their receipts using a smartphone, and upload them to the app, no matter where they are on the road!

"With Budgetly, the expense management process now with virtual cards means that there is a record of all transactions which is far better than a cash system.”

Greg Massam, CEO

Directions Disability Support Services

How Budgetly's virtual corporate cards improve spending control

CFO's are using Budgetly’s fuel card alternative to stay ahead of their competitors, in control of expenses and empowering team members to spend autonomously within budgets.

No more shared cards, no more waiting on banks

Fast money requests & fund approvals

Simplified bookkeeping & hours saved on admin

Goodbye to reimbursements & chasing receipts!

Flexible spending within budgets with spending rules

Real-time budget & transaction visibility

Easy digital receipt tracking via the mobile app

Sync with accounting software

Fast and accurate transactions

Complete data protection 2FA & 256 bit encryption

Reduce risk of fraud

Expense policy compliance with card encoded rules

Frequently asked questions about Budgetly

What is a budget?

Budgets are your spending rules in Budgetly. They allow administrators to allocate set amounts for users to spend within chosen timeframes, giving the ability to set and control staff spending, whilst tracking available funds before and after purchases.

Can I have more than one budget for a user?

Yes, you can have one or multiple for any user - this allows you to set up specific spend limits on areas, departments, people, anything you like! You can be as granular or broad as you like with budgets - our team can help you tailor them to your needs. Read more about creating budgets here.

How much does Budgetly cost?

Sign up for a plan that suits your finance team. Unlimited users, payments, support and receipts. View our pricing page for all the details.

Is Budgetly secure?

Budgetly is designed with your privacy and security in mind. Read more about our Security measures here.

What are the future enhancements planned for supplier management?

Future enhancements include adding supplier limits, improved supplier management, supplier cards, and additional fraud prevention mechanisms.

How can I find out if Budgetly is a good fit for my business?

For more information on Budgetly and how we work for your business, easily schedule a complimentary strategy call with us today, or watch a 10-min on-demand demo.

Find out how Budgetly virtual corporate cards will empower employees, free up finance

Fill out the form to watch a 10 minute demo of Budgetly's virtual corporate cards (and why they are the best fuel card alternative for Australian businesses!)