Aspire Education saves each centre 1 day a week in expense management

“We previously used bank credit cards, and we’d have to collect receipts and reconcile them for each centre manually. But now we have 15 centres running through Budgetly and have saved at least a day per week for each centre!”

Jacqueline Chuang, Accountant

Overview

Aspire Education is an Early Childhood Education provider with 15 centres in Victoria. The organisation previously allocated two bank credit cards for each centre, which staff would transact and provide receipts.

However, this process posed a couple of challenges:

- Outstanding receipts. Finance teams spent a lot of time chasing staff for receipts, which weren’t always available.

- Long credit card waits. The company needed more credit cards to manage expenses effectively, but it took months for bank credit cards to arrive.

- Manual Reconciliation. Upon collecting receipts, finance teams would have to reconcile each receipt to the transaction manually.

- Managing accounts across centres. Aspire Education employed over 500 employees, and managing expenses using two credit cards at each centre wasn’t a long-term solution.

Budgetly Solution

Aspire Education’s finance team searched for an expense management solution and was promptly responded to by Budgetly. The company was supplied with 28 prepaid corporate cards across their 15 early education centres.

Budgetly’s virtual cards were set up instantly upon application and finance teams could order unlimited cards for staff. This removed the long wait times for bank credit cards and lengthy paperwork.

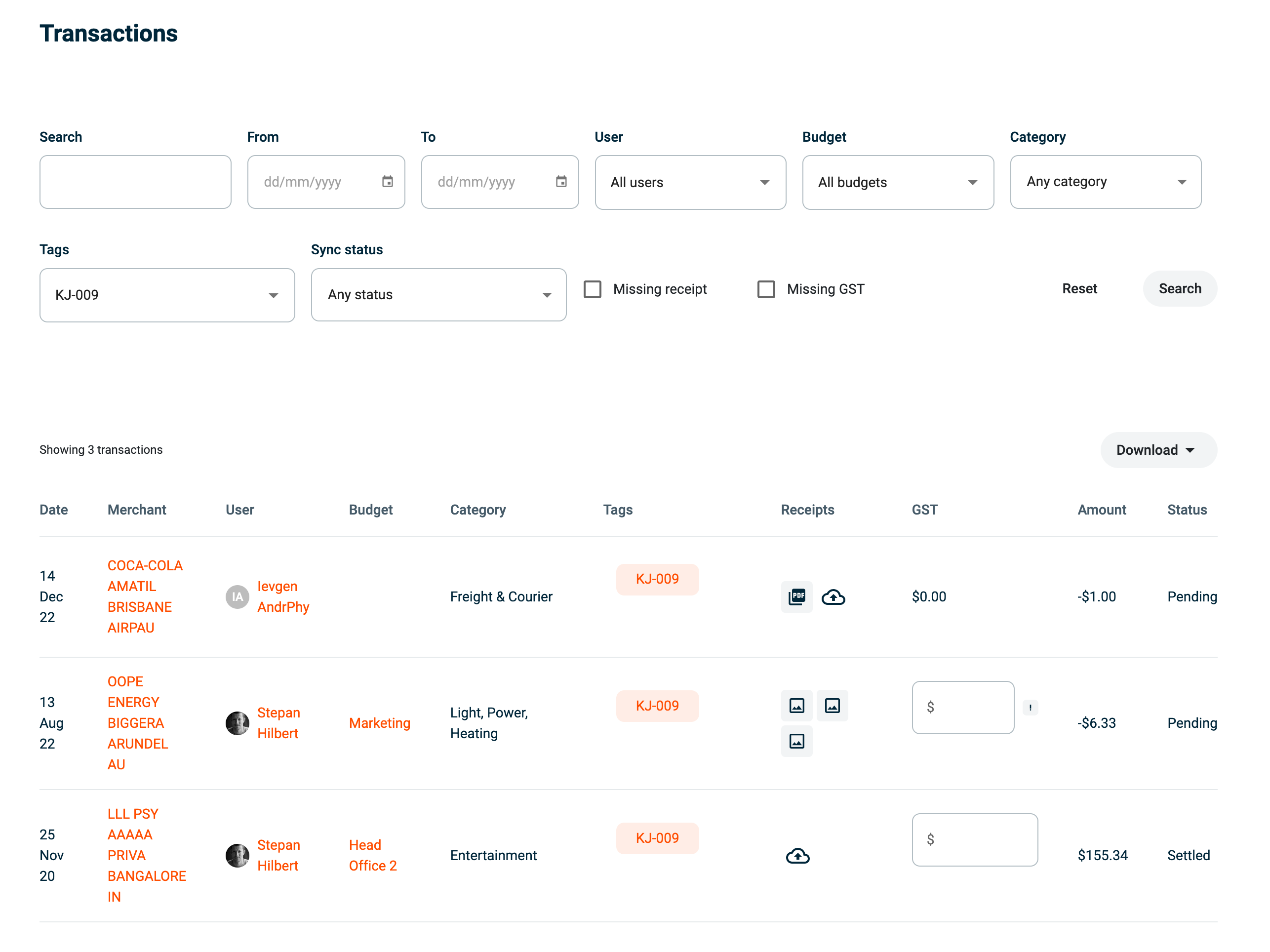

Using the Budgetly cards, company staff can transact, capture their receipts using a smartphone, and upload them to the app. In addition, Budgetly’s expense management software automatically records transaction details such as vendor names and transaction amounts.

Finance teams no longer have to chase for receipts and can also see transactions in real-time, giving them greater visibility and control over staff spending.

Example of Budgetly’s transactions view

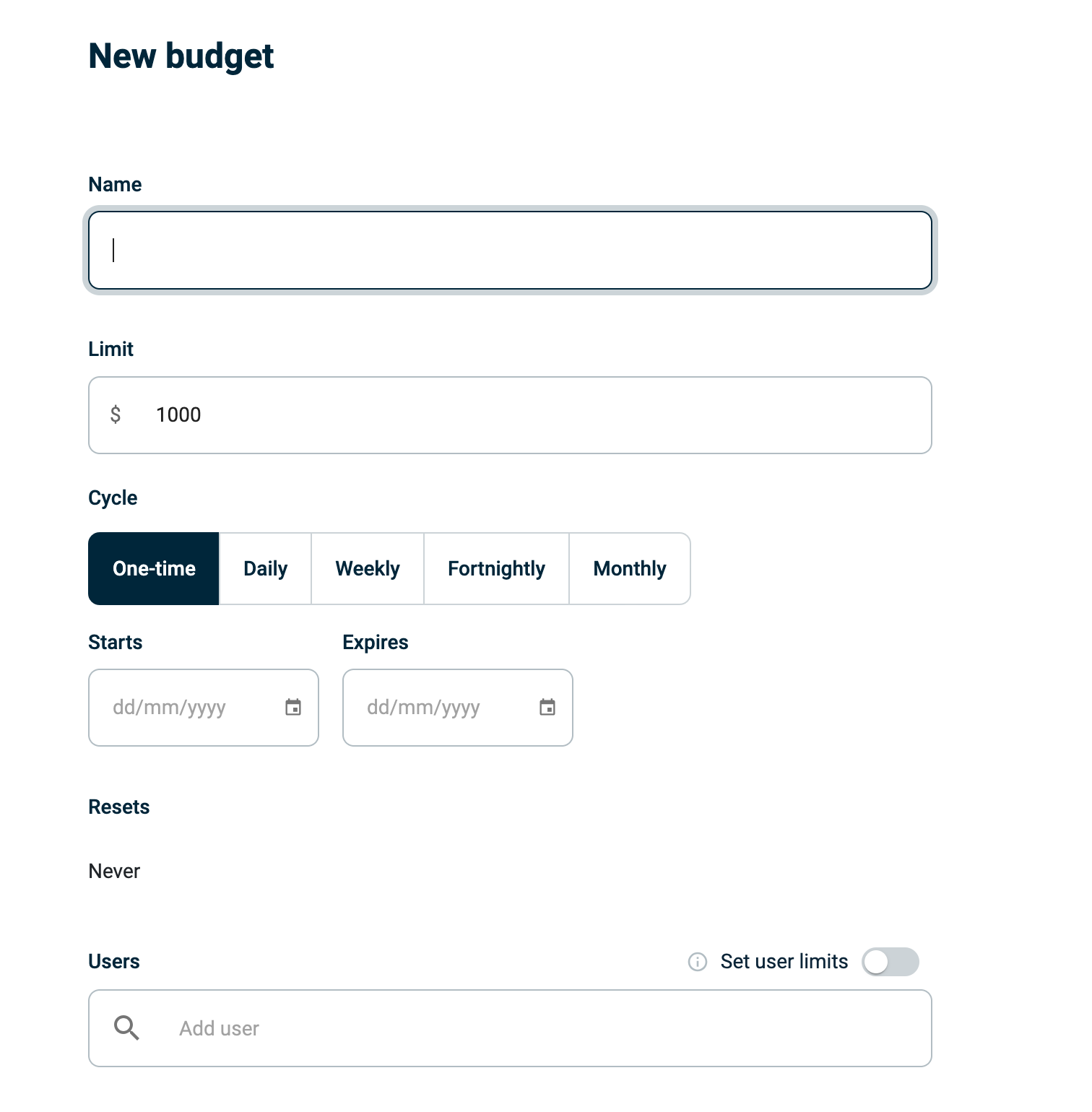

Additionally, finance teams can also allocate separate budgets and set spending limits on each staff and across all centres. These budgets can be automated to reset or rollover every fortnight.

Example of Budgetly’s budgeting functionalities

Requesting a money top-up is hassle-free on the app, and finance teams can approve them with a click of a button. In addition, all staff transactions can be viewed on the software, giving administrators more control over company budgets.

With Budgetly, Aspire Education can additionally use these expense management features to help them manage company funds:

- Cancel or freeze cards with a click of a button

- Flag any unnecessary transactions with Budgetly’s real-time view

- Automatic reconciliation of each transaction

- Sync all transactions with Xero

- Generate easy and quick transaction reports for audits

Results

1. Local Support

Along with the expense management solution, Aspire Education has support from Budgetly’s Australian team for any queries and concerns.

“We initially used an international expense management solution. But after a month, we realised that this would be difficult with them being based overseas, so we found Budgetly as a local alternative. The support has been great and any initial issues we had were handled with a quick response time.”

Jacqueline Chuang, Accountant

Budgetly’s automatic reconciliation has saved the education provider time on tedious administrative tasks, allowing them to focus on what matters.

“With Budgetly, we’ve saved a significant amount of time, which is where the value has been for us. Without it, we would still manually reconcile everything across all 15 education centres. We can now focus on other things in our businesses instead of all the manual reconciliation.”

Jacqueline Chuang, Accountant

Budgetly’s easy and unlimited prepaid corporate card setup has enabled the company to move quickly with expenses - instead of waiting for cards from the bank.

“We used to deal with our bank to get new cards, which can take a considerable amount of time. Now we can order our own cards whenever we need them, and collecting receipts is significantly easier.”

Jacqueline Chuang, Accountant

4. Better expense management process

Handling expenses across 15 childcare education centres was previously a hassle. But with Budgetly’s help, Aspire Education has managed to streamline their expense management process.

“Budgetly has definitely solved our initial problems, everything is now much more centralised, and we can easily see all our accounts in one spot. Now we have an individual account for each of our 15 childcare centres, and each centre has a few Budgetly cards. I’d definitely recommend Budgelty to other businesses.”

Jacqueline Chuang, Accountant

For more information on Budgetly and how we work for businesses, schedule a demo with us today, or watch a 10-minute recorded demo.

About Aspire Education Capital Pty Ltd

Aspire Education is an early learning centre that strives to provide high-quality education and care that’s delivered by professional, passionate educators. The organisation operates multiple centres across Victoria, with various educational and social programs for young children and toddlers.

About Budgetly

Budgetly is an Australian prepaid corporate card and expense management software provider. We’re committed to making expense management easy for all companies and improving their expense processes. Our service is adopted by many NDIS providers, aged care providers, charities, and businesses across Australia.